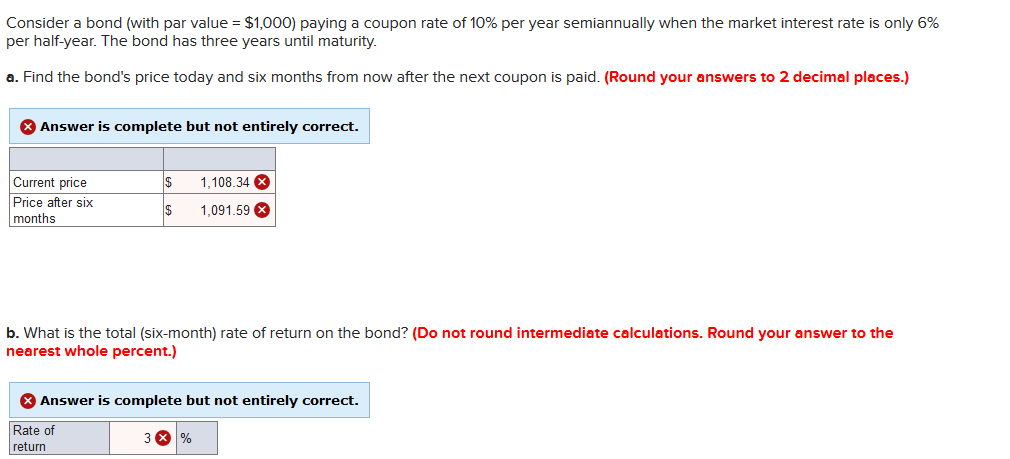

45 consider a bond paying a coupon rate of 10 per year semiannually when the market

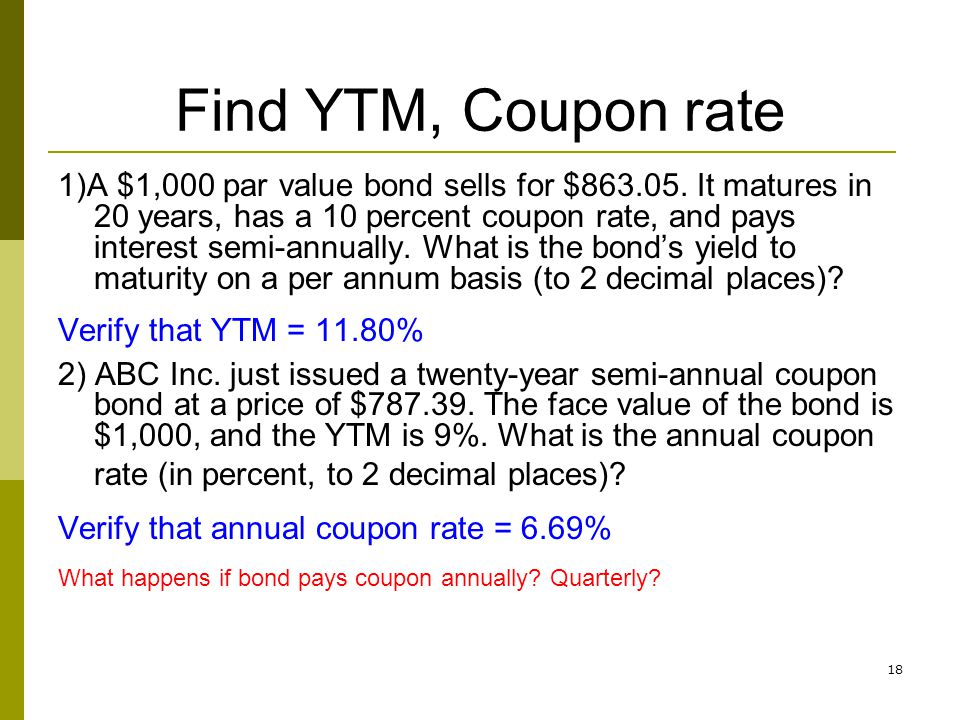

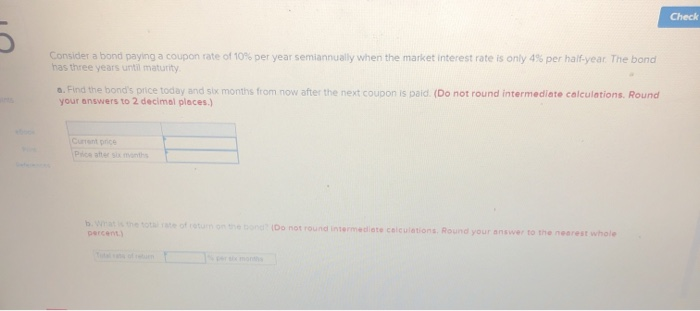

Course Help Online - Have your academic paper written by a ... With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life. Consider a bond paying a coupon rate of 10% per year semiann - Quizlet Expert solutions Question Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Find the bond's price today and six months from now after the next coupon is paid. Solutions Verified Solution A Solution B Create an account to view solutions

Solved > uestion Consider a bond paying a coupon rate:457084 ... Question Consider a bond paying a coupon rate of 9.75% per year semiannually when the market interest rate is only 3.9% per half-year. The bond has... Question Consider a bond (same as previous question) with $1000 par value, 13 annual coupon payments remaining, coupon rate of 6.8 percent, and yield to maturity... Question Consider a bond ...

Consider a bond paying a coupon rate of 10 per year semiannually when the market

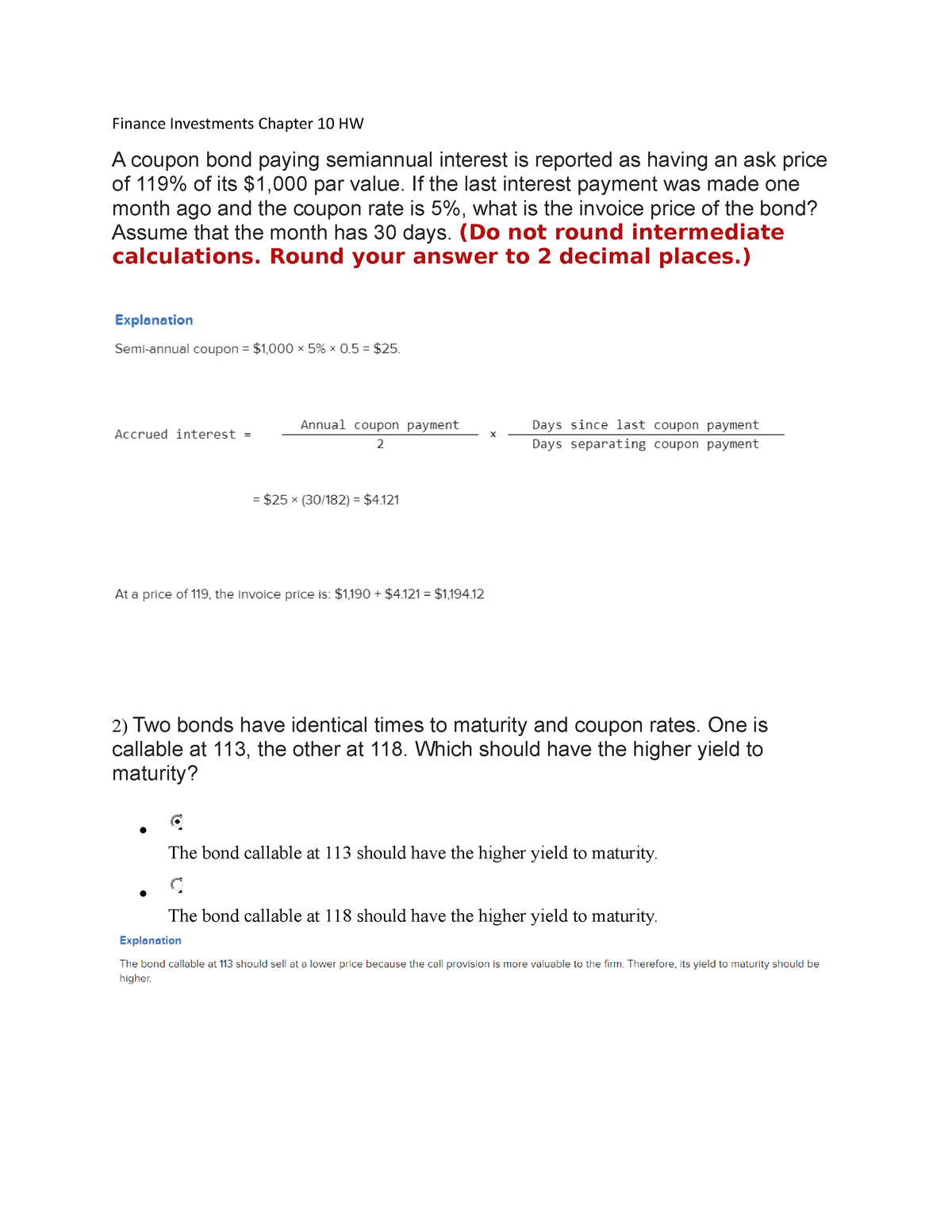

Finance Investments Chapter 10 HW - FINC 3440 - SU - StuDocu Consider a bond paying a coupon rate of 7% per year semiannually when the market interest rate is only 3% per half-year. The bond has six years until maturity. a. ** Find the bond's price today and six months from now after the next coupon is paid. ... 8% coupon bond paying coupons semiannually is callable in six years at a call price of $1,105 ... Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

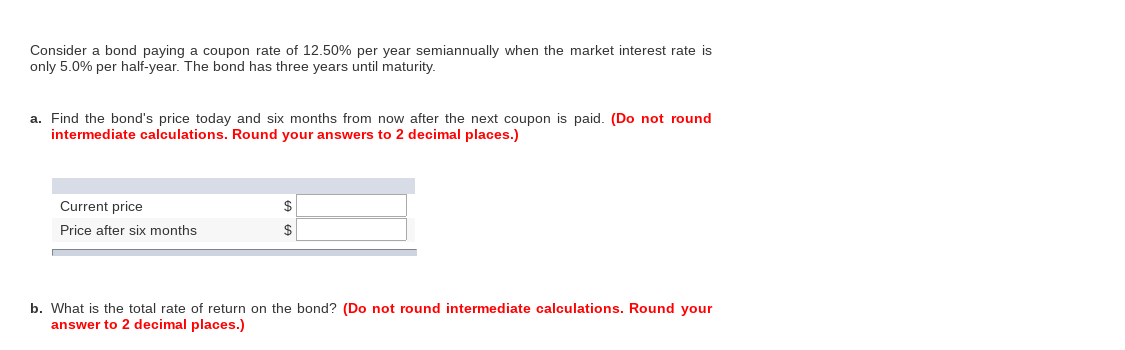

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Assignment Essays - Best Custom Writing Services $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. ... We offer the lowest prices per page in the industry ... Solved Consider a bond paying a coupon rate of 10.50% per - Chegg Question: Consider a bond paying a coupon rate of 10.50% per year semiannually when the market interest rate is only 4.2% per half-year. The bond has two years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Success Essays - Assisting students with assignments online $10.91 The best writer. $3.99 Outline. $21.99 Unlimited Revisions. Get all these features for $65.77 FREE. ... We offer the lowest prices per page in the industry ... Interest Rates and Bond Valuation - Sungkyunkwan University •Consider a bond with a coupon rate of 10% and annual coupons. The par value is $1,000, and the bond has 5 years to maturity. The ... 10 year maturity, 8% coupon rate, $1,000 par value Yield-to-Maturity (YTM) rs. 4 ... of $140 per year, but this $140 will come in two payments of $70 each. The yield to

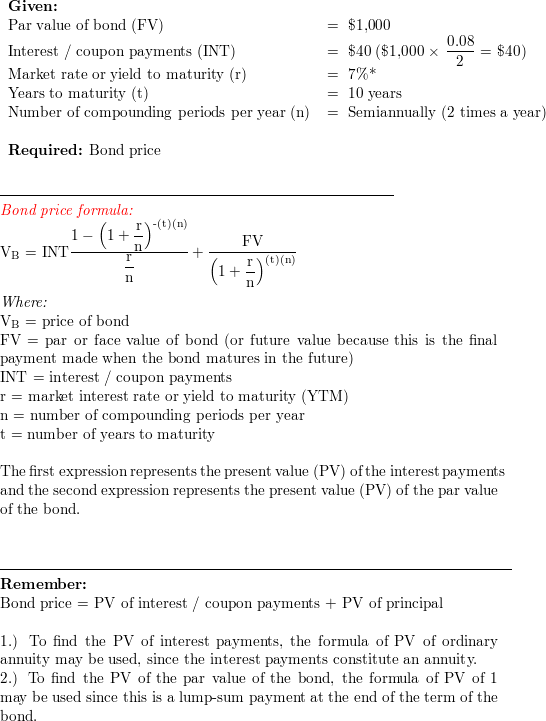

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid. 1. Consider a bond paying a coupon rate of 10% per year...open 5 - Quesba 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond? 2. Investments Final Flashcards | Quizlet Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today. 1,000 FV, 50 PMT, 6 N, 4.25 I/Y CPT PV = 1,038.99805 Price = $1,039.00 YTM- Zero Coupon Bond Bond Coupon Interest Rate: How It Affects Price - Investopedia Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's par value, also known as the "face value." A $1,000 bond has a face value of $1,000. If its coupon rate...

Par Bond - Overview, Bond Pricing Formula, Example Example 3: Par Bond. Consider a bond with a 5-year maturity and a coupon rate of 5%. The market interest rate is 5%. For the bond above, the coupon rate is equal to the market interest rate. In such a scenario, a rational investor would only be willing to purchase the bond at par to its face value because its coupon return is the same as the ... (Solved) - Consider a bond paying a coupon rate of 10% per year ... 1 Answer to Consider a ... Answered: Consider a bond paying a coupon rate of… | bartleby Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years until maturity. This initial payment is $1000. A: What is find the bond's price today and 6 months time after the next coupon is paid Question Consider a bond (with par value = $1,000) paying a coupon rate of 8% ... Consider a bond (with par value = $1,000) paying a coupon rate of 8% per year semiannually when the market interest rate is only 6% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.) Advertisement

Consider a bond paying a coupon rate of 10% per year semiannually when ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4%. The bond has 3 years until maturity. a. Find the bond price today and six months from now after the next coupon is paid, assuming the market rate will be constant during the following 6 months. b.

OneClass: Problem 10-16 Consider a bond paying a coupon rate of 8. Problem 10-16 Consider a bond paying a coupon rate of 8.50% per year semiannually when the market interest rate is only 3.4% per half-year. The bond has four years until maturity. a. Find the bond's price today and eight months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

(Get Answer) - Consider a bond paying a coupon rate of 9.25% per year ... Consider a bond paying a coupon rate of 9.25% per year semiannually when the market interest rate is only 3.7% per half-year. The bond has five years until maturity a. Find the bond's price today and six months from now alter the next coupon is paid. b. What is the total rate of return on the bond? Total rate of % per six months Expert's Answer

When is a bond's coupon rate and yield to maturity the same? - Investopedia The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. So if...

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond?

[Solved] Consider a bond paying a coupon rate of 1 | SolutionInn Consider a bond paying a coupon rate of 12.25% per year semiannually when the market interest rate is only 4.9% per half-year. The bond has six years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

[Solved] Consider a bond paying a coupon rate of 1 | SolutionInn Consider a bond paying a coupon rate of 10% per. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b.

How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Pro Rata: What It Means and the Formula to Calculate It Jul 18, 2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ...

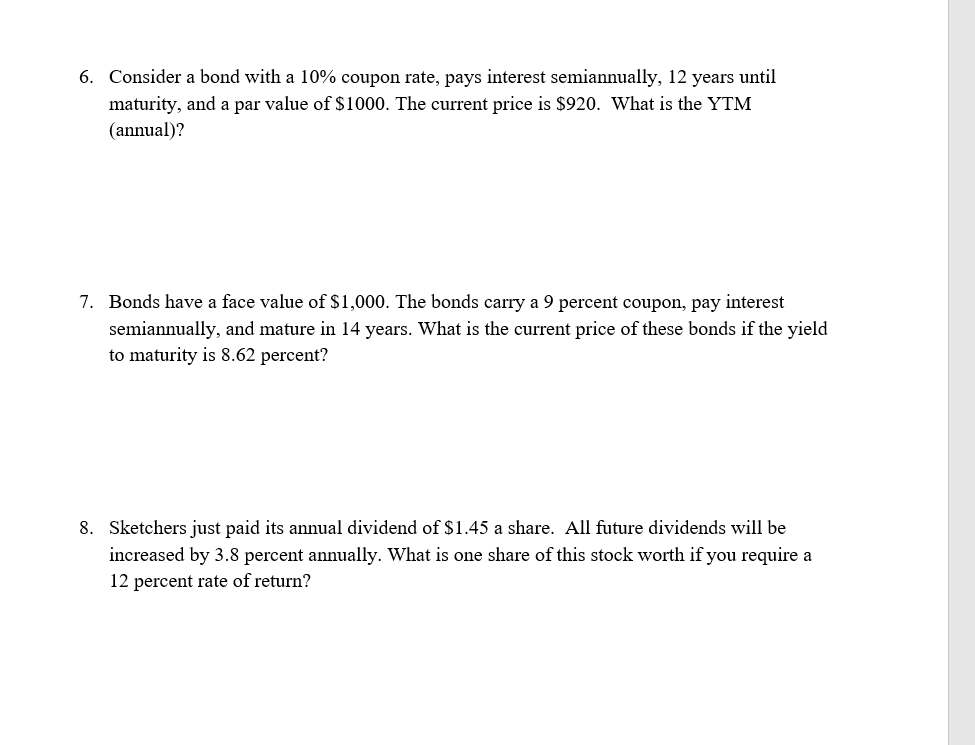

Yield to Maturity and Default Risk - Rate Return - Do Financial Blog Consider an 8% coupon bond selling for $953.10 with three years until maturity making annual coupon payments. The interest rates in the next three years will be, with certainty, r1 = 8%, r2 = 10%, and r3 = 12%. Calculate the yield to maturity and realized compound yield of the bond. 6.

1. Consider a bond paying a coupon rate of 10% per year...get 5 - Quesba Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a) Find the bond's price today and six months from now after the next coupon is paid.

Answered: Consider a bond paying a coupon rate of… | bartleby Business Finance Q&A Library Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years until maturity. This initial payment is $1000. A: What is find the bond's price today and 6 months time after the next coupon is paid?

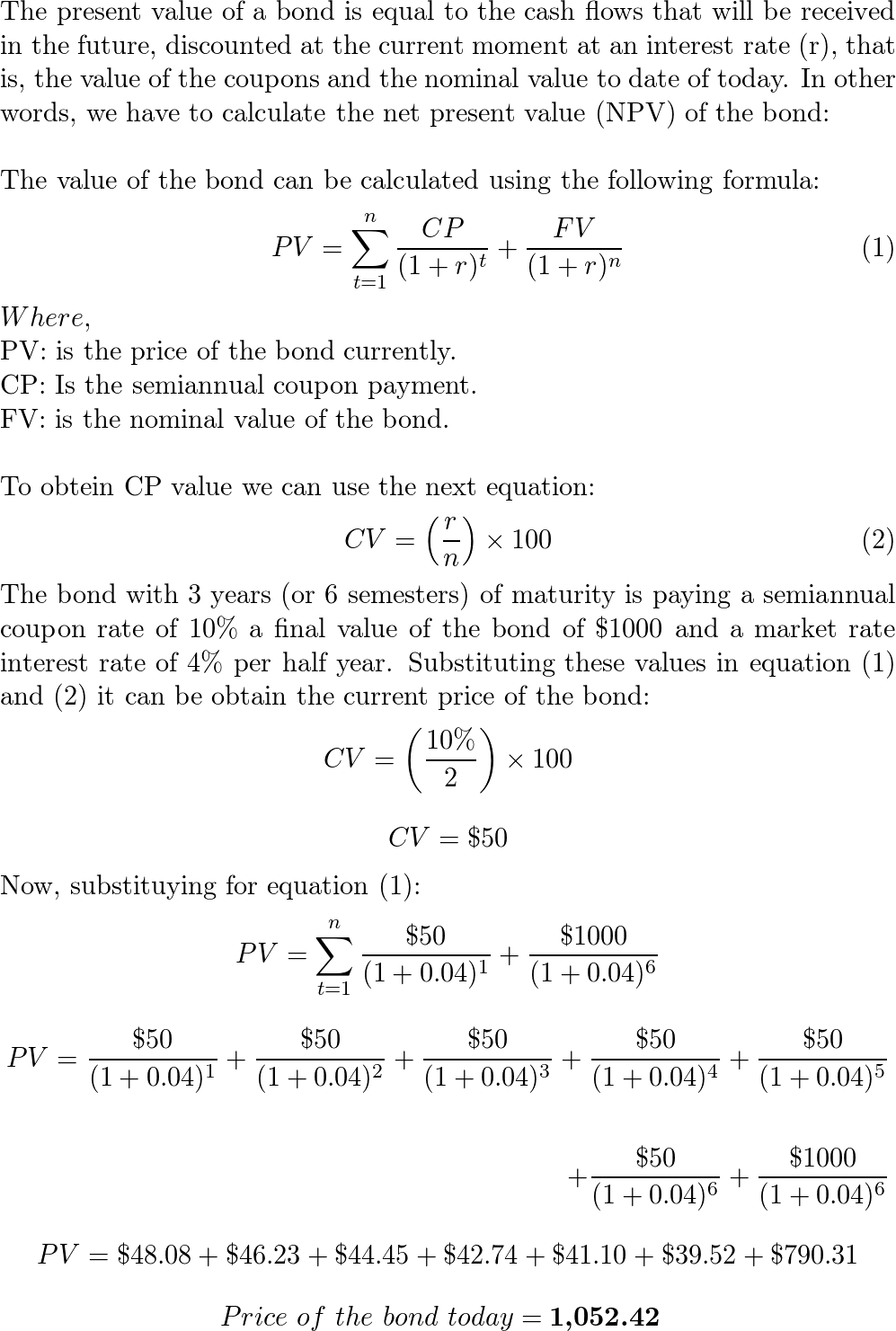

Consider a bond paying a coupon rate of 10 per year semiannually when ... The 3 year bond is paying a 10% coupon rate (semi-annually) that has a market rate interest rate of 4% per half year. a. Calculate the bond price. PMT = (10%/2 x 1,000) = 50 FV = 1,000 n = 3 years x 2 = 6 r = 4% PV = 1,052.42 Price of the bond six months from now can be calculated by assuming that market interest rate remains 4% per half year.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Achiever Papers - We help students improve their academic ... With course help online, you pay for academic writing help and we give you a legal service. This service is similar to paying a tutor to help improve your skills. Our online services is trustworthy and it cares about your learning and your degree. Hence, you should be sure of the fact that our online essay help cannot harm your academic life.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

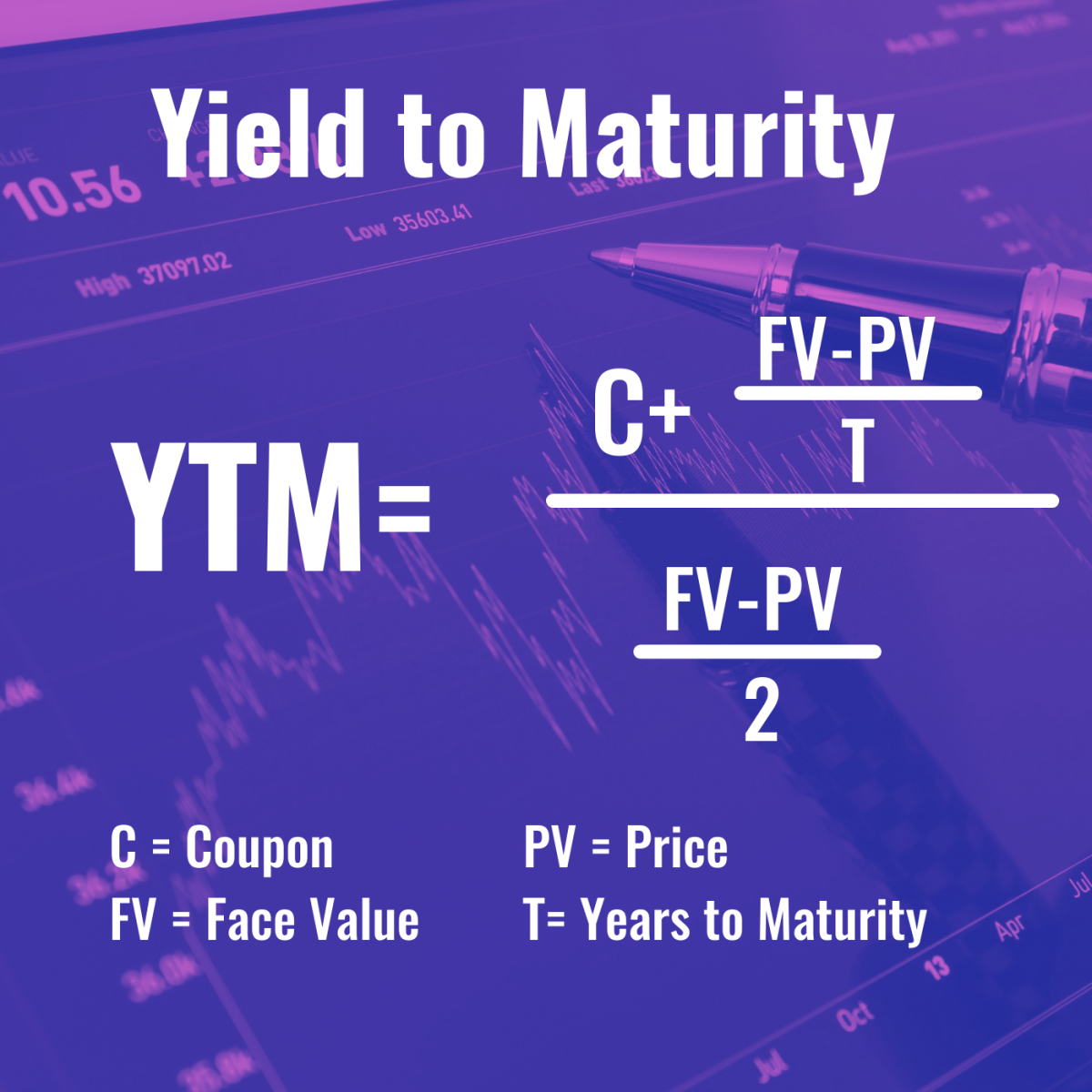

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Finance Investments Chapter 10 HW - FINC 3440 - SU - StuDocu Consider a bond paying a coupon rate of 7% per year semiannually when the market interest rate is only 3% per half-year. The bond has six years until maturity. a. ** Find the bond's price today and six months from now after the next coupon is paid. ... 8% coupon bond paying coupons semiannually is callable in six years at a call price of $1,105 ...

![Solved] Assume you have a bond with a 5% coupon rate, a $1000 ...](https://www.cliffsnotes.com/tutors-problems/assets/img/attachments/14550380.jpg)

Post a Comment for "45 consider a bond paying a coupon rate of 10 per year semiannually when the market"