42 coupon vs interest rate

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. What is the difference between the coupon / interest rate and the ... What is the difference between the coupon / interest rate and the yield / rate of return? ... The coupon rate is the interest rate paid by the issuer for that ...

What is difference between coupon rate and interest rate? - Quora The coupon rate is calculated on the face value of the bond which is being invested. The interest rate is calculated considering on the basis of the riskiness ...

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Coupon vs interest rate

Discount Rate vs Interest Rate | 7 Best Difference (with ... The interest rate will be higher if the borrower’s profile is considered risky, the rate of interest charged on them will be on the higher side. Head to Head Comparison Between Discount Rate vs Interest Rate (Infographics) Below is the top 7 difference between Discount Rate vs Interest Rate: Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

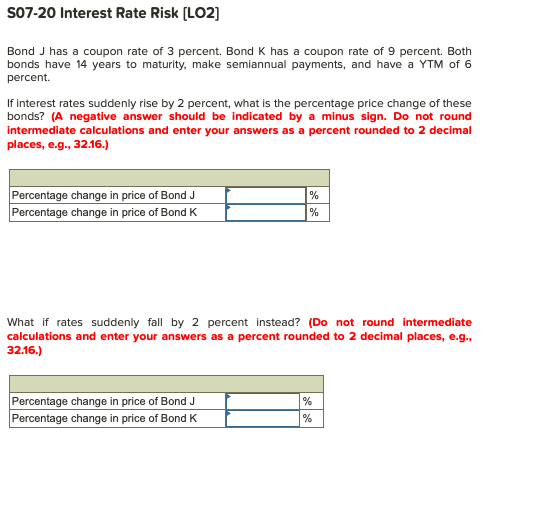

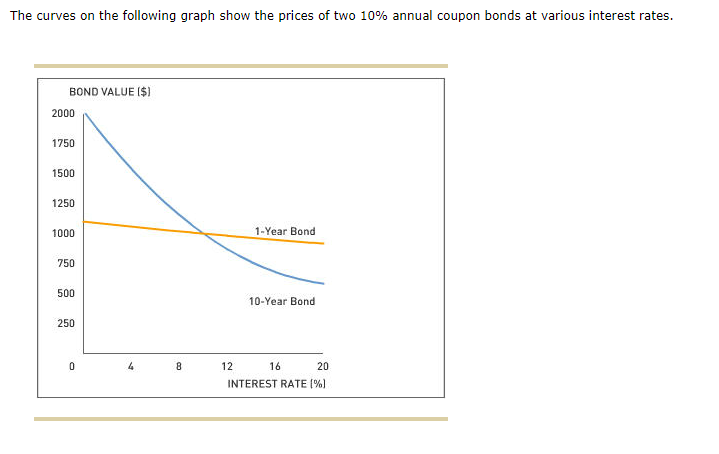

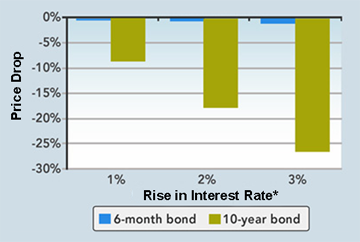

Coupon vs interest rate. Coupon Rate - Definition - The Economic Times Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the ... Coupon Rate vs Interest Rate - WallStreetMojo The coupon rate can be considered as the yield on a fixed-income security. The interest rate is the rate charged by the lender to the borrower for the borrowed ... Difference Between Coupon Rate and Interest Rate [Updated 2022] The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest ... Chapter 6 -- Interest Rates - California State University ... interest rates Interest rate price risk: an increase in interest rates causes a decrease in bond value Interest reinvestment risk: a decrease in interest rates leads to a decline in reinvestment income from a bond (2) If the required rate of return (or discount rate) is higher than the coupon rate, the value of the bond will be less than the ...

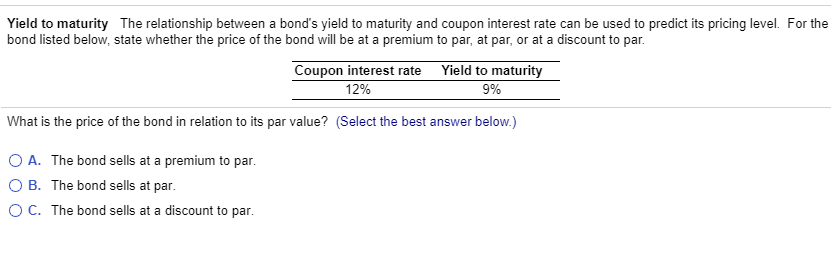

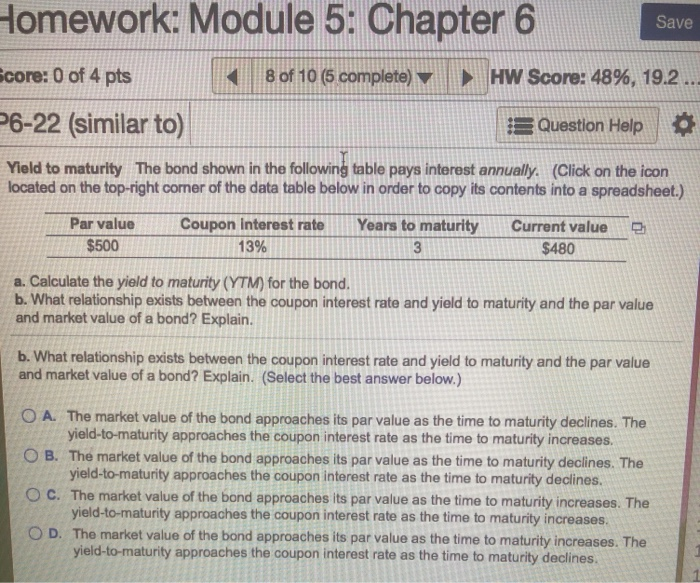

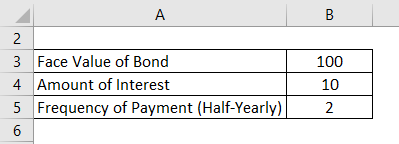

Interest Rates and Bond Pricing - Morningstar When a bond is issued, it pays a fixed rate of interest called a coupon rate until it matures. This rate is related to the current prevailing interest rates ... Learn How Coupon Rate Affects Bond Pricing Coupon Rate vs. Yield-to-Maturity ... The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield- ... Bond Yield Rate vs. Coupon Rate: What's the Difference? Coupon rates are the yields associated with regular interest payments made by bonds and are influenced by prevailing interest rates. · A bond's yield is the rate ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Coupon Rate vs Interest Rate | Top 6 Best Differences ... - eduCBA Coupon Rate vs Interest Rate Comparison Table ; Coupon Rates are much more flexible, Interest Rates remains more or less static during the tenure of the loan. Federal Discount Rate | Federal Reserve Rates - Bankrate Sep 20, 2022 · How it's used: The Fed uses the discount rate to control the supply of available funds, which in turn influences inflation and overall interest rates. The more money available, the more likely ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Discount Rate vs Interest Rate | 7 Best Difference (with ... The interest rate will be higher if the borrower’s profile is considered risky, the rate of interest charged on them will be on the higher side. Head to Head Comparison Between Discount Rate vs Interest Rate (Infographics) Below is the top 7 difference between Discount Rate vs Interest Rate:

![Difference Between Coupon Rate and Interest Rate [Updated 2022]](https://askanydifference.com/wp-content/uploads/2021/04/Coupon-Rate-vs-Interest-Rate.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "42 coupon vs interest rate"