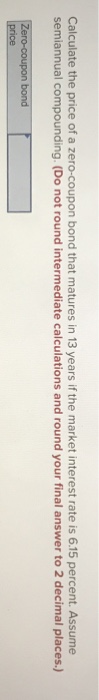

41 calculate price zero coupon bond

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. Issuing Premium & Discount Bonds | Process, Advantages & Disadvantages ... Zero-Coupon bond: A discount bond is given at a 20% discount or more when the maturity levels are high. This means the bond price may rise significantly towards the end of the maturity period ...

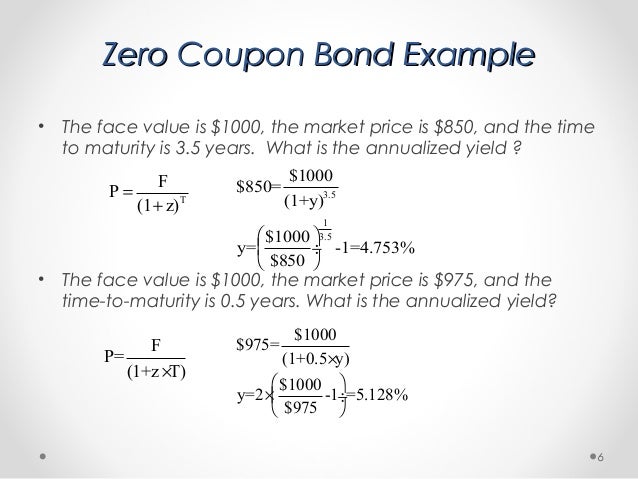

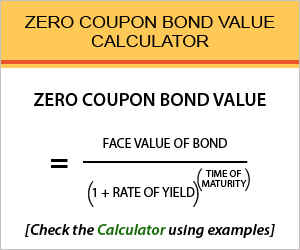

Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

Calculate price zero coupon bond

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the... Today's Prices - TreasuryDirect cusip security type rate maturity date call date buy sell end of day; 912796xn4: market based bill: 0.000%: 08/23/2022: 0.000000: 99.994250: 0.000000: 912796t58: market based bill Zero Percent Certificate Of Indebtedness Zero Coupon Bond Value Calculator: Calculate Price, Yield to …. The Treasury also offers zero-percent certificate of indebtedness (C of I) which can be used to fund TreasuryDirect purchases. ETFs. There are mutliple popular long-duration bond ETFs for investors seeking to track the market in a liquid form without purchasing bonds directly..

Calculate price zero coupon bond. How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can calculate the price of … solved:A 20-year, $1,000 par value zero-coupon rate bond is to be A 20-year, $1,000 par value zero-coupon rate bond is to be issuedto yield 7 percent. UseAppendix Bfor an approximate answer but calculate your final answer using the formula and financial calculator methods .a.What should be the initial price of the bond? ( Assume annual compounding. Zero-Coupon Bond Definition - Investopedia 31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... United Kingdom Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. United Kingdom Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

Fince3020 quantitative problem chapter 3 - Answer Shark Calculate the present value of $1,000 zero-coupon bond with 5 years to maturity if the required annual interest rate is 6%. 2-A lottery claims its grand prize is $10 million, payable over 20 years at $500,000 per year. ... Calculate the actual price change using discounted cash flow. 13. The duration of a $100 million portfolio is 10 years. $40 ... United States Government Bonds - Yields Curve United States Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. How to Calculate Macaulay Duration in Excel - Investopedia The formula used to calculate the percentage change in the price of the bond is the change in yield to maturity multiplied by the negative value of the modified duration multiplied by 100%.... Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency - How often the bond makes a coupon payment, per year. If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market ...

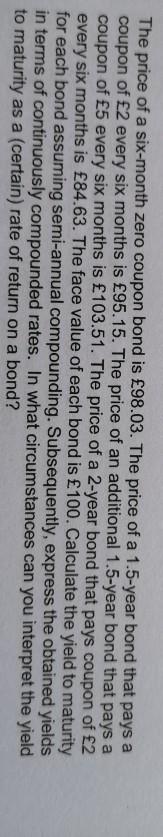

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. (Get Answer) - Semiannual Bonds. The market price is the price as of ... Semiannual Bonds. The market price is the price as of today (2022). 1. Amazon has a bond outstanding with an AA rating, $1,000 par value, and 4.8% coupon rate, paid semiannually. The bond was issued in 2014 and matures in 2034. If the current market price is $1,189.23 what is the yield... Calculate Price of Bond using Spot Rates | CFA Level 1 27.09.2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

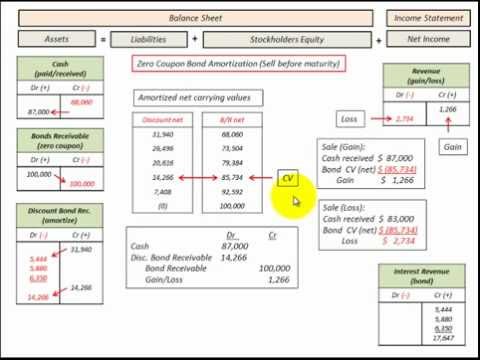

How to Calculate PV of a Different Bond Type With Excel - Investopedia 20.02.2022 · A. Zero Coupon Bonds Let's say we have a zero coupon bond (a bond which does not deliver any coupon payment during the life of the bond but sells at a discount from the par value) maturing in 20 ...

EOF

The Ultimate Guide to Discount Bond - Forward Finance To calculate a bond's return, yield to maturity takes into account the bond's current market price, par value, coupon interest rate, and time to maturity. Although the YTM computation is complicated, numerous online financial calculators can calculate the YTM of a bond. ... Distressed and Zero-Coupon Bonds .

PIMCO 25 Year Zero Coupon U.S. Treasury Index Exchange ... - Benzinga PIMCO 25 Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (ARCA: ZROZ) ... 100x Options Profit Calculator. ... What is the target price for PIMCO 25 Year Zero Coupon U.S. Treasury Index ...

How to Calculate the Price of a Bond With Semiannual Coupon … 24.04.2019 · Concluding the example, adding the present values of each payment results in a total present value of $964.91. This means the bond's price needs to be $964.91 to achieve an equivalent return. If you can get a lower price, you'll enjoy a higher return, but if you have to pay a higher price, you're better off opting for the alternative investment.

solved:How to calculate the above bond's full price, clean price a ... How to calculate the above bond's full price, clean price and… Coupon 1.700000 Type Fixed Composite AA+ Cpn Freq S/A Day Cnt 30/360 Iss Price 99.98300 Issuance& Trading Maturity 02/22/2019 Amt Issued/Outstanding MAKE WHOLE @12.500000 until02/22/19/BULLET USD 1,000,000.00 (M) / Iss Sprd 80.00bp vs T 0 34 02/15/19 USD 1,000,000…. Show more…

Daily Treasury Yield Curve Rates - YCharts Japan Government Bonds Interest Rates: Aug 23 2022, 19:30 EDT: Bank of Japan Basic Discount Rate: Aug 23 2022, 19:50 EDT: Euro Short-Term Rate: Aug 24 2022, 02:00 EDT: Spain Interest Rates: Aug 24 2022, 04:00 EDT: European Long Term Interest Rates: Aug 24 2022, 04:00 EDT

Zero Percent Certificate Of Indebtedness Zero Coupon Bond Value Calculator: Calculate Price, Yield to …. The Treasury also offers zero-percent certificate of indebtedness (C of I) which can be used to fund TreasuryDirect purchases. ETFs. There are mutliple popular long-duration bond ETFs for investors seeking to track the market in a liquid form without purchasing bonds directly..

Today's Prices - TreasuryDirect cusip security type rate maturity date call date buy sell end of day; 912796xn4: market based bill: 0.000%: 08/23/2022: 0.000000: 99.994250: 0.000000: 912796t58: market based bill

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

Post a Comment for "41 calculate price zero coupon bond"