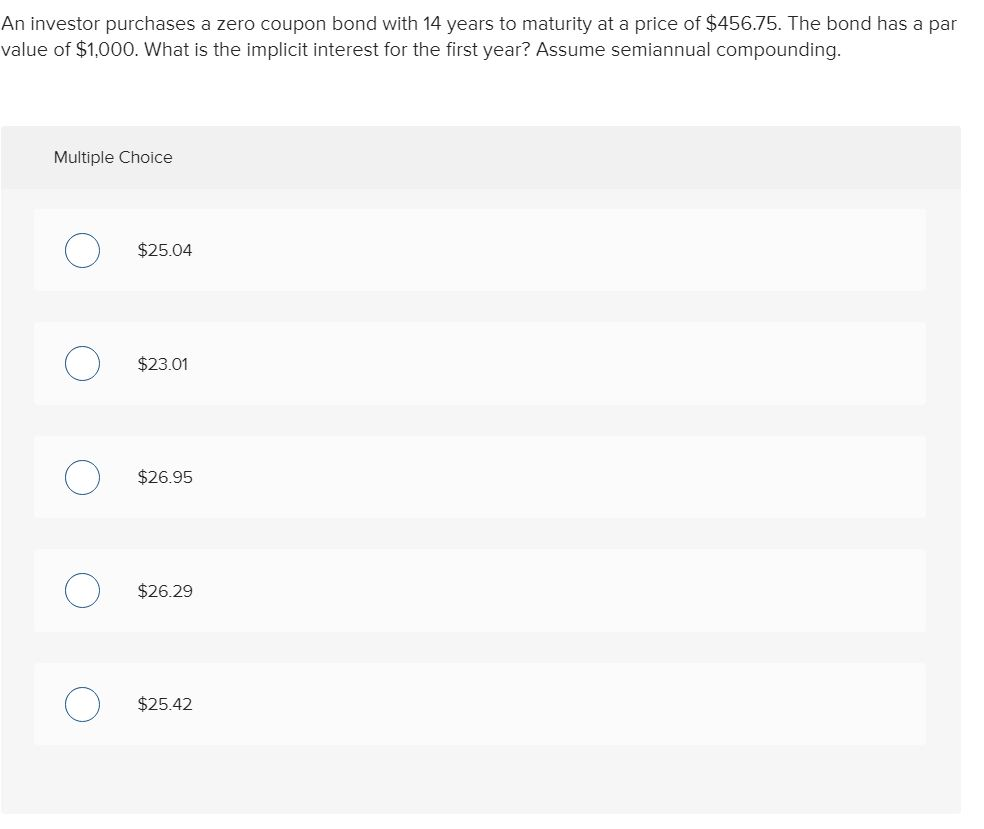

45 valuing zero coupon bonds

Valuing a zero-coupon bond - Mastering Python for Finance [Book] A zero-coupon bond is a bond that does not pay any periodic interest except on maturity, where the principal or face value is repaid. Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, and is the time remaining to the maturity of the bond. Model for valuing bonds and embedded options - Eagle Traders Since the average present value is equal to the target value of $100, r1 is 0.04074 = 4.074%. We're not done. Suppose that we want to "grow" this tree for one more year-that is, we must determine r2.We will use a three-year on-the-run 4.5% coupon bond to get r2.The same five steps are used in an iterative process to find the one-year rates two years forward.

PDF Valuation of zero coupon bonds using Excel - CROSBI For determining the value and duration of zero coupon bonds, oped applying custom made formulas by authors and standard financial functions built in Excel. [7] For explanation of the models two examples are presented below. A. Zero coupon bonds with annual compounding According to the following data about a zero coupon bond

Valuing zero coupon bonds

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Advantages and Risks of Zero Coupon Treasury Bonds General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Valuing zero coupon bonds. Zero-Coupon Bonds - Acing Finance To find the present value of a zero-coupon bond, we take the face value and divide it by the interest rate to the power of time to maturity. The formula is Where r is the interest rate, and t is the time to maturity. Example: A 3-year zero-coupon bond is issued with a face value of $1000 and an interest rate of 8%. Zero Coupon Bond | Definition, Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds... Bond Valuation Mastery - Learn To Value Bonds From Scratch. Value a Zero-Coupon Bond from scratch. Estimate the price of a Straight / Vanilla bond. Value a Consol (aka 'Perpetual Bond), and see why the formula works. Valuing Bonds (Advanced) Value bonds with semi-annual and quarterly coupons. Explore the impact of compounding on bond prices. See first hand how a change in the yield impacts the value ... Solved 2. Valuing a Zero-Coupon Bond. Assume the following | Chegg.com 2. Valuing a Zero-Coupon Bond. Assume the following information for existing zero-coupon bonds: Par value = $100,000 Maturity = 3 years Required rate of return by investors = 12% How much should investors be willing to pay for these bonds?

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Valuing Bonds - Pace University Consider the following three bonds: Bond 1: A 2 year, 10% coupon bond with a $1000 face value. Bond 2: A 2 year, 8.8% coupon bond with a $1000 face value. Bond 3: A 2 year, 8% coupon bond with a $1000 face value. Note that the bonds only vary by coupon rate. The prices of the bonds are equal to 50 + 1000/(1.09) 2 = 50 x 3.596 + 841.68 = 1021.46 Valuing a zero-coupon bond - Mastering Python for Finance - Second Edition A zero-coupon bond is a bond that does not pay any periodic interest except on maturity, where the principal or face value is repaid. Zero - Coupon Bonds - Economy Blatt Zero - coupon bonds are also called pure discount bonds as they trade at a discount, a price lower than the face value prior to its maturity date. Suppose you have purchased a one - year, risk - free, zero coupon bond which has an initial price of $ 144,927. The face value of the bond is $150,000.

PDF Numerical Example in Valuing Zero coupon Bonds For example, the value of a zero coupon bond will increase from $385.00 to $620.92 as the bond moves from 10 years to maturity to 5 years to maturity assuming interest rates remain at 10%. 4) Compare the value of the zero at 10 years to maturity when rates are 10% versus when they are 7%. Lower interest rates mean higher bond prices. Valuing Bonds | Boundless Accounting | | Course Hero Formula for Calculating Value of Zero-Coupon Bond Zero-Coupon Bond Value = Face Value of Bond / (1+ interest Rate) Generally, the price of a zero-coupon bond is based on the present value of the amount the issuing business will pay the bondholder when the bond matures. The amount the company pays at the end of the term equals the bond's face value. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Solved 1. Valuing a Zero-Coupon Bond Assume the | Chegg.com Valuing a Zero-Coupon Bond Assume that you require a 14 percent return on a zero-coupon bond with a par value of $1,000 and six years to maturity. What is the price you should be willing to pay for this bond? (Pease note that you have to answer this two problems step by step not directly, as my professor want it step by step, please provide a ...

Zero Coupon Bond - YouTube An example of pricing a zero-coupon bond using the 5-key approach.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Valuing a zero-coupon bond | Mastering Python for Finance Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, and is the time remaining to the maturity of the bond. Let's take a look at an example of a 5-year zero-coupon bond with a face value of $100. The yield is 5 percent, compounded annually.

Zero Coupon Bonds Explained (With Examples) - Fervent | Finance Courses ... Valuing Zero Coupon Bonds on Excel® We'll be using Excel's "PRICE" function to value Swindon Plc's bond. The first thing you want to do is setup your spreadsheet with a pro-forma / template that consists of the all different variables you'll need. The "PRICE" function on Excel® requires:

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations.

zero coupon bonds - Vertaling naar Nederlands - voorbeelden Engels ... Vertalingen in context van "zero coupon bonds" in Engels-Nederlands van Reverso Context: Annex XIX should be amended to include a formula for valuing zero coupon bonds. Vertaling Proeflezer Synoniemen Vervoegen. Meer. Vervoegen Documents Grammatica Woordenboek Expressio. Reverso for Windows.

11 valuing a zero coupon bond a a zero coupon bond A zero-coupon bond with a par value of $1,000 matures in 10 years. At what price wouldthis bond provide a yield to maturity that matches the current market rate of 8 percent? ANSWER: ANSWER : PV 11)k( C += PV 100801 0001).(, += PV= $463.19 b. What happens to the price of this bond if interest rates fall to 6 percent?

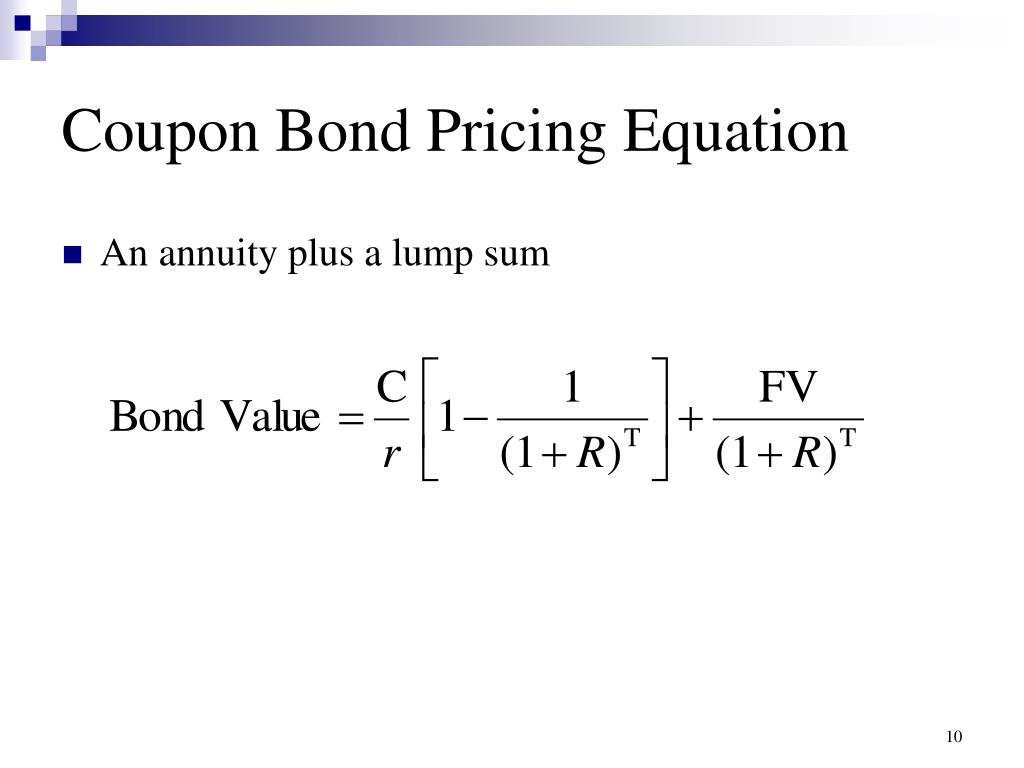

How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Valuing a zero-coupon bond | Mastering Python for Finance - Second Edition Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, y is the annually-compounded yield or rate of the bond, and t is the time remaining to the maturity of the bond. Let's take a look at an example of a five-year zero-coupon bond with a face value of $ 100. The yield is 5%, compounded annually.

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Advantages and Risks of Zero Coupon Treasury Bonds General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000...

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

Post a Comment for "45 valuing zero coupon bonds"