38 a general co bond has an 8% coupon

uestion 2 of 36 A semi-annual-pay bond with a par value of R1,000 is ... The bond has an 8% coupon and 10 years to... Question uestion 2 of 36 A semi-annual-pay bond with a par value of R1,000 is callable in 5 years at R1,080. The bond has an 8% coupon and 10 years to maturity. If the current yield to maturity is 9.6%, the yield to call is closest to: A. 9.29%. B. 10.67%. C. 11.97%. D. 12.67%. Bond Coupon Interest Rate: How It Affects Price - Investopedia Say that a $1,000 face value bond has a coupon interest rate of 5%. No matter what happens to the bond's price, the bondholder receives $50 that year from the issuer. However, if the bond price...

Buying a $1,000 Bond With a Coupon of 10% - Investopedia Conversely, if the bond price were to shoot up to $1,250, its yield would decrease to 8% ($100 / $1,250), but again, you would still receive the same $50 semi-annual coupon payments. This is...

A general co bond has an 8% coupon

CF Chp 8 Flashcards - Quizlet All else constant, a coupon bond that is selling at a premium, must have: A. a coupon rate that is equal to the yield to maturity. B. a market price that is less than par value. C. semi-annual interest payments. D. a yield to maturity that is less than the coupon rate. E. a coupon rate that is less than the yield to maturity The bonds of the Nordy Company have a coupon interest rate of 9%.... The value of each bond is $1,000. The formula for the value of a bond is: Value = Par value * (1 + Coupon rate * Number of years to maturity) / (1 + Required rate of return) For this problem, we have: The implications of this are that if the interest is paid annually, the value of the bond will be higher than if it is paid semiannually. Answered: A 10-year corporate bond has a coupon… | bartleby Q: XYZ Company has a 12-year bond with an 8% annual coupon and a face value of P1000. The bond has a… A: Bond Valuation: It is the process used for determining the actual or fair price of the fixed income…

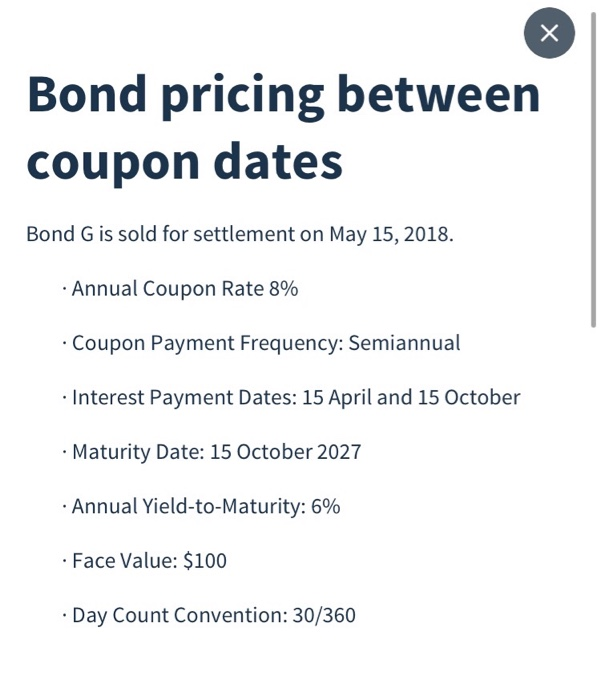

A general co bond has an 8% coupon. Coupon Bond - Investopedia Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means... Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Expert Answer 100% (10 ratings) Yield to Maturity is the internal rate of return of the Bond. It represents the amount of profit or loss on the … GENERAL MOTORS CO.DL-NOTES 2017(17/27) Bond - Insider The General Motors Co.-Bond has a maturity date of 10/1/2027 and offers a coupon of 4.2000%. The payment of the coupon will take place 2.0 times per biannual on the 01.04.. At the current price of ... Answered: Bond prices. Price the bonds from the… | bartleby a. Find the price for the bond in the following table: (Round to the nearest cent.) Years to Yield to Par Value Coupon Rate Maturity Maturity Price $5,000.00 11% 30 8%. Bond prices. Price the bonds from the following table with monthly coupon payments: Hint: make sure to round all intermediate calculations to at least seven decimal places.

6 Coupon Rate General Matters outstanding bond issue has ... - Course Hero 11 . Bond Prices and Yields .1 . Several years ago , Castles in the Sand , Inc. , issued bonds at face value at a yield to maturity of 7 % . Now , with 8 years left until the maturity of the bonds , the company has run into hard times and the yield to maturity on the bonds has increased to 15 % . Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. FINN EXAM 2 Flashcards | Quizlet Select one: a. The zero coupon bond must have a higher price because of its greater capital gain potential. b. Both bonds must sell for the same price if markets are in equilibrium. c. The zero coupon bond must sell for a lower price than the bond with an 8% coupon rate. d. All rational investors will prefer the 8% bond because it pays more ... FINN 3226 CH. 4 Flashcards - Quizlet A 10-year bond pays an annual coupon, its YTM is 8%, and it currently trades at a premium. Which of the following statements is CORRECT? a. If the yield to maturity remains at 8%, then the bond's price will decline over the next year. b. If the yield to maturity increases, then the bond's price will increase. c.

FIN 3000 HW 6 Flashcards - Quizlet Coupon rate = 8% A 2-year maturity bond with face value of $1,000 makes annual coupon payments of $80 and is selling at face value. What will be the rate of return on the bond if its yield to maturity at the end of the year is: a. 6% b. 8% c. 10% a. 9.89% b. 8.00% c. 6.18% You buy a bond for $980 that has a coupon rate of 8% and a 10-year maturity. CHP 7 Flashcards | Quizlet This bond has an annual coupon payment of $130. N=10 I=10 CPT PV=-1184 PMT=130 FV= 1000 Example of pricing a Discount Bond: The same company also has 10-year bonds outstanding with the same risk but a 7% annual coupon rate. This bond has an annual coupon payment of $70. Vanilla Ice Co bonds pay an annual coupon rate of 10 and have 12 years ... 4. General Electric 30-year bonds have a 7.5% annual coupon rate and a par value of their bonds be? FV=10,000 N=30 PMT=750 I/Y=6.25%. 5. Austin Power Co. bonds have a 14% annual coupon rate. Interest is paid semi-annually. The bonds have a par value of $1,000 and will mature 10 years from now. If the ... A General Co. bond has an 8 % coupon and pays interest annually. 1)The Lone Star Co. has $1,000 par value bonds outstanding at 9% interest. The bonds will mature in 20yrs. Compute the current price of the bonds if the present yield to maturity is: (a) 6% (b) 8% (c) …

Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Finance Chapter 5 Flashcards - Quizlet A 12-year, 5% coupon bond pays interest annually. The bond has a face value of $1,000. What is the change in the price of this bond if the market yield rises to 6% from the current yield of 4.5%? 12.38% decrease. The Lo Sun Corporation offers a 6% bond with a current market price of $875.05.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

Foundations of Finance - Class 8 and 9 - Quizlet All have the same degree of default risk and mature in 10 years. The first is a zero-coupon bond that pays $1,000 at maturity. The second has an 8% coupon rate and pays the $80 coupon once per year. The third has a 10% coupon rate and pays the $100 coupon once per year. a. If all three bonds are now priced to yield 8% to maturity, what are ...

Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com Question: A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity This problem has been solved! See the answer Show transcribed image text Expert Answer YTM = 40 + (1000-1020.5)/5 … View the full answer

Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 7.82% 8.12% 8.04% 7.79% 8.00% Question: A General Co. bond has an 8% coupon and pays interest annually.

Yield to Maturity Questions and Answers | Study.com Dilli Co. has 10% coupon bonds making annual payments with a yield to maturity of 8.2%. The current yield on these bonds is 8.8%. ... A bond has a coupon rate of 8%, pays interest annually and ...

Answered: A 10-year corporate bond has a coupon… | bartleby Q: XYZ Company has a 12-year bond with an 8% annual coupon and a face value of P1000. The bond has a… A: Bond Valuation: It is the process used for determining the actual or fair price of the fixed income…

The bonds of the Nordy Company have a coupon interest rate of 9%.... The value of each bond is $1,000. The formula for the value of a bond is: Value = Par value * (1 + Coupon rate * Number of years to maturity) / (1 + Required rate of return) For this problem, we have: The implications of this are that if the interest is paid annually, the value of the bond will be higher than if it is paid semiannually.

CF Chp 8 Flashcards - Quizlet All else constant, a coupon bond that is selling at a premium, must have: A. a coupon rate that is equal to the yield to maturity. B. a market price that is less than par value. C. semi-annual interest payments. D. a yield to maturity that is less than the coupon rate. E. a coupon rate that is less than the yield to maturity

Post a Comment for "38 a general co bond has an 8% coupon"