smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? Dec 03, 2019 · Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments then divide that by the bond’s par value: ($50 + $50) = $100. $100 / $1,000 = 0.10. The bond’s coupon rate is 10 percent. This is the portion of its value that it repays investors every year.

The coupon rate of a bond is equal to

How to Calculate Bond Discount Rate: 14 Steps (with Pictures)

Solved: You Own A Bond With A Coupon Rate Of 5.1 Percent A... | Chegg.com

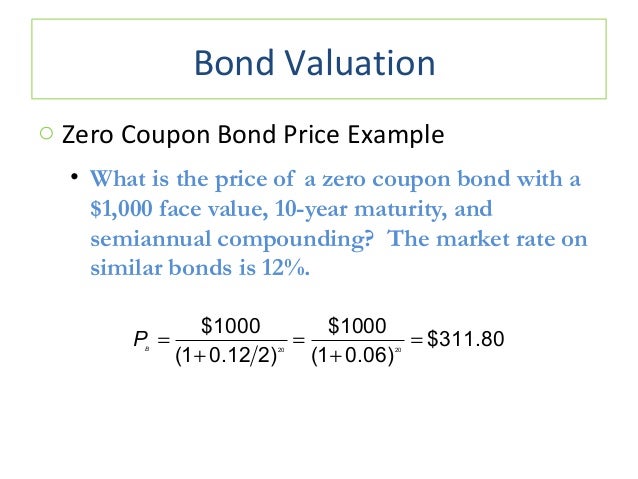

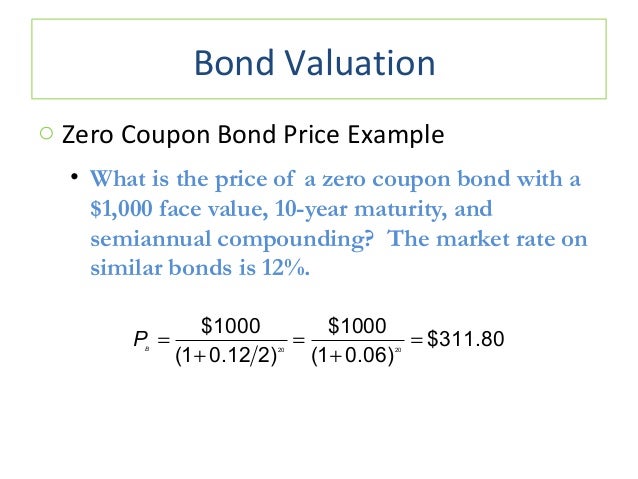

2. bond valuation_and_interest_rates

CFA Level 1: CFA Study Preparation

Solved: Bond A Has The Following Terms: Coupon Rate Of Int... | Chegg.com

Bond - GlynHolton.com

Solved: Bond Prices. Price The Bonds From The Following Ta... | Chegg.com

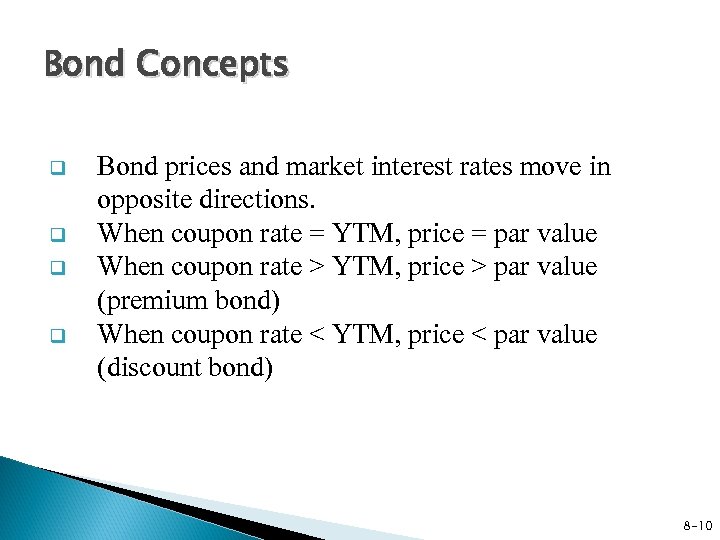

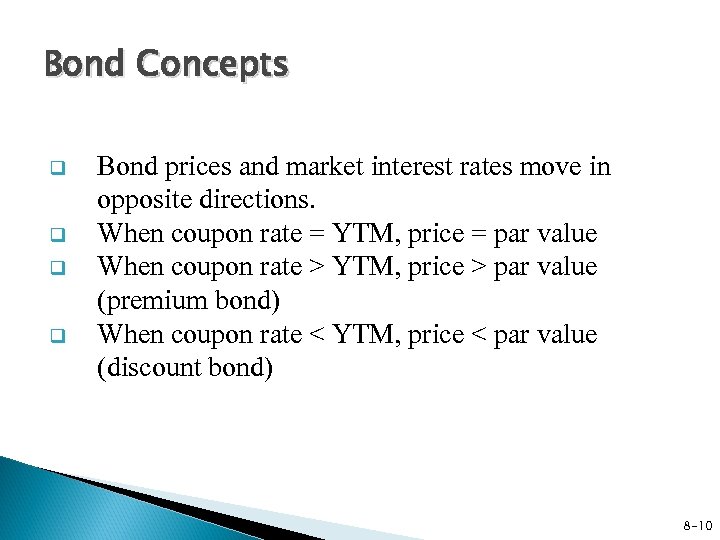

Berk Chapter 8: Valuing Bonds

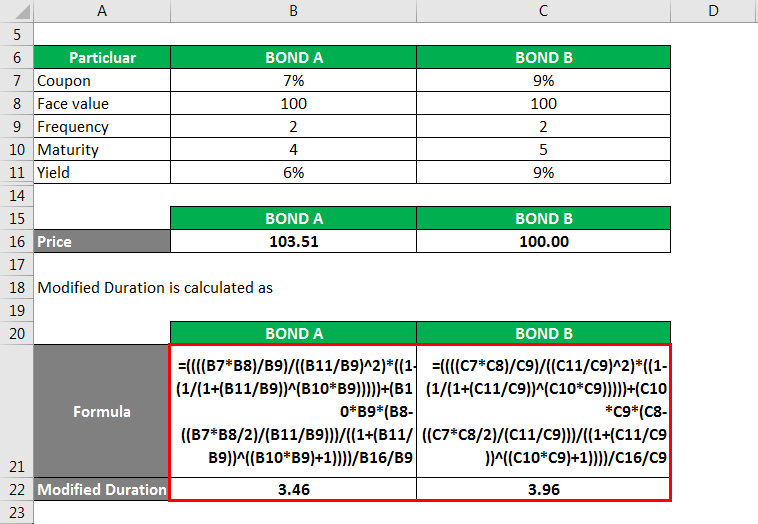

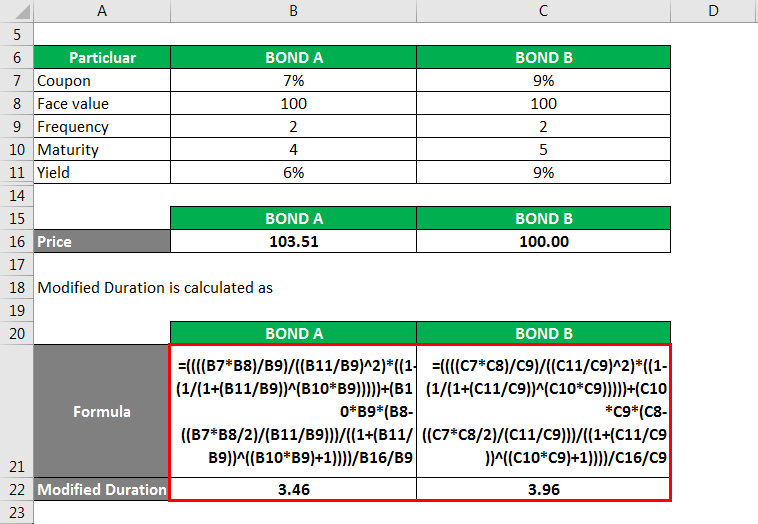

Macaulay Duration Formula | Example with Excel Template

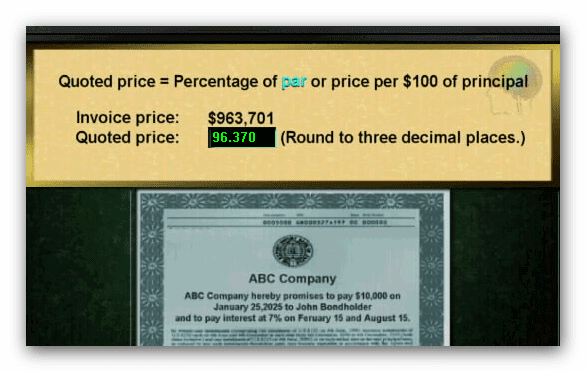

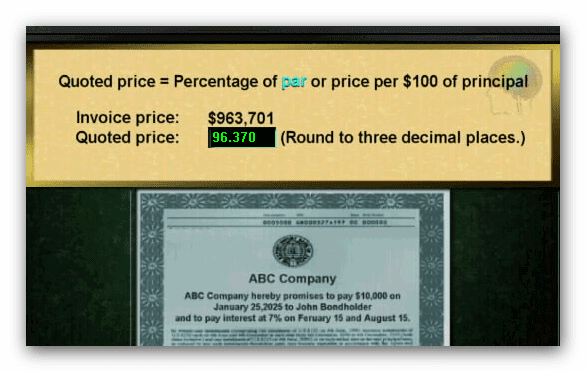

What are Bonds. How to trade bonds online

Approaches to Calculating the Cost of Capital | Boundless Finance

Coupon Rate Formula - simple-accounting

(Bond valuation) Hamilton, Inc. bonds have a coupon rate of 8 percent. The interest is paid ...

How to Calculate Bond Prices - ToughNickel

Post a Comment for "39 the coupon rate of a bond is equal to"