38 treasury bills coupon rate

Treasury Bills (T-Bills) Definition Dec 12, 2021 · What Is a Treasury Bill (T-Bill)? A Treasury Bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less. Treasury bills are ... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

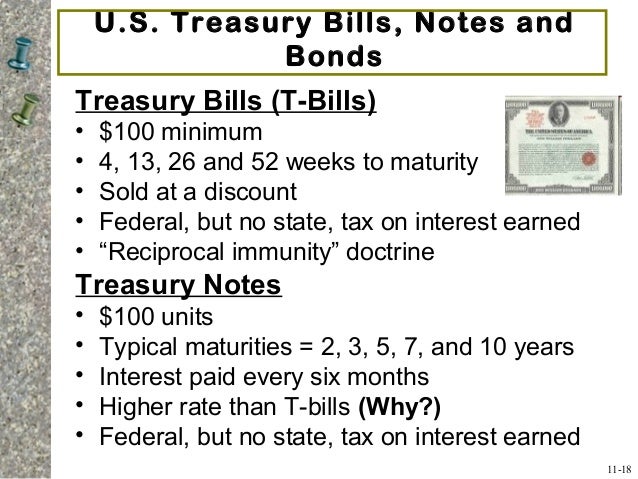

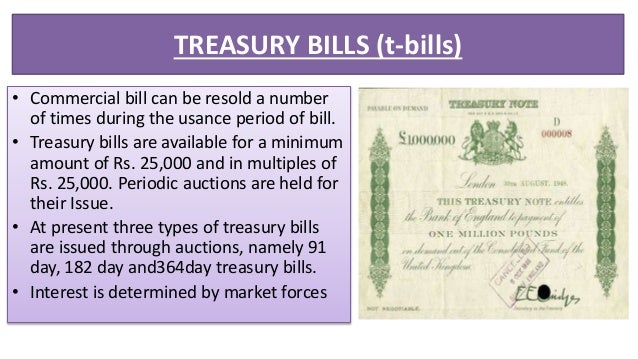

Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Treasury Bills. Treasury bills categories into 3 bills as per maturity namely, a) 91 Day b) 182 Day c) 364 Day. Treasury bills are sold out at a discounting price, and it did not pay any interest. Treasury Bills is also called as T-Bills. A treasury bill is only typed instrument which is found in both capital and money market.

Treasury bills coupon rate

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Treasury Bills (T-Bills) - What They Are & How to Buy for Investment The Treasury auctions T-bills to investors, who purchase the security at a discount to the face value. For example, an investor may purchase a bill with a $1,000 face value and a six-month maturity at a price of $950. In six months, when the investment matures, the investor receives $1,000, producing $50 in profit. Understanding Coupon Rate and Yield to Maturity of Bonds The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4.

Treasury bills coupon rate. › terms › tTreasury Bills (T-Bills) Definition Dec 12, 2021 · What Is a Treasury Bill (T-Bill)? A Treasury Bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less. Treasury bills are ... Individual - Treasury Bills In Depth Feb 10, 2021 · Bills are sold at a discount. The discount rate is determined at auction. Bills pay interest only at maturity. The interest is equal to the face value minus the purchase price. Bills are sold in increments of $100. The minimum purchase is $100. All bills except 52-week bills and cash management bills are auctioned every week. Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid. Treasury Bills (T Bills): Definition, Rates & Maturity If the yield on a T-bill is less than the inflation rate, an investor will suffer a loss when the bill is redeemed. The inflation rate in 2021 was 7.5%, so investors holding T-bills with coupon...

Treasury Bonds vs. Treasury Notes vs. Treasury Bills Mar 29, 2022 · Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ... › treasury-bills-vs-bondsTreasury Bills vs Bonds | Top 5 Differences (with Infographics) Bonds. Definition. Treasury bills are debt papers issued by the government or corporate in order to raise money. T-Bills have a tenure of less than one year. Bonds are also debt instruments issued by government and corporate in order to raise debt. Tenure for corporate bonds is equal to or more than 2 years. Tenure. Investing in Treasury Bills: The Safest Investment in 2022 May 30, 2021 · Treasury notes have maturities from two to 10 years. And Treasury bonds mature 20 years or later. (For simplicity, this article refers to all three as “Treasury bills” or “T-bills” or simply “Treasuries.”) Treasury bills are seen as the safest bonds in the world because they are backed by the U.S. government. And because of their ... India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-.

10 Year Treasury Rate - YCharts Apr 26, 2022 · Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 2.97%, compared to 2.99% the previous market day and 1.63% last year. What Is a Treasury Note? How Treasury Notes Work for Beginners Treasury bills have maturities of two, three, five, seven, and ten years. Treasury bills, notes, and bonds, are all forms of debt commitments that the United States Treasury sells. ... Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields ... Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ... Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more: T-bills do not pay any coupon.

Individual - Treasury Bills: How To Buy Nov 16, 2016 · Treasury Bills: How To Buy. You can buy Treasury bills directly from the U.S. Treasury or through a bank, broker, or dealer. ... By bidding for a bill in TreasuryDirect, you: Agree to accept whatever discount rate is determined at auction; Are guaranteed to receive the bill you want, in the amount you want (This is called noncompetitive bidding.)

Treasury I-Bonds are Paying 7.12%! — Sapient Investments Right now, the fixed rate is zero (and has been since November 1, 2019). Because the latest 6-month increase in the CPI (3.56%) rose at an annualized rate of 7.12%, that is the current yield for I-bonds. If the CPI cools, the yield may decline, but can never become negative. Consequently, the accrued value of an I-bond can never decline.

Treasury Bill Rates The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year.

Treasury Rates, Interest Rates, Yields - Barchart.com This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. ... Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least ...

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Treasury Coupon Bonds - Economy Watch The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate.[br] ... Some fixed income securities such as US Savings bonds and US Treasury Bills are zero coupon bonds. You can buy certain treasury ...

The yield on a discount basis of a 90-day, $1,000 Treasury bill selling for $950 is - The yield ...

Daily Treasury Bill Rates Data - CKAN The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill's yield based on the purchase price, discount, and a 365- or 366-day year.

How does the U.S. Treasury decide what coupon rate to offer on ... - Quora Answer (1 of 3): The coupon is usually set close to yield within typical rates i.e. 1/16th or 1/32 to generate a near par price. Trading too far away from par will either raise less money or reduce the appetite for investors if it is purchased way above par. The new issue or on-the-run can also ...

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

Minutes of the Meeting of the Treasury Borrowing Advisory Committee May ... The Committee convened in a closed session at the Department of the Treasury at 9:00 a.m. All members were present. Under Secretary for Domestic Finance Nellie Liang, Fiscal Assistant Secretary David Lebryk, Deputy Assistant Secretary for Federal Finance Brian Smith, Director of the Office of Debt Management Fred Pietrangeli, and Deputy Director of the Office of Debt Management Nick Steele ...

Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

How Are Treasury Bill Interest Rates Determined? For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the...

Individual - Treasury Notes: Rates & Terms Treasury Bills. Treasury Notes. Buy. Reinvest or Redeem. Sell. Transfer. Rates & Terms. Tax Consider-ations. Product FAQs. ... Treasury Notes: Rates & Terms . Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. ... Interest Coupon Rate Price Explanation; Discount (price below par) 10-year Note Issue Date ...

Treasury Bills - Guide to Understanding How T-Bills Work Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up to 52 weeks. ... Coupon Rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond.

Treasury Bonds | CBK Mar 21, 2022 · five year fixed coupon treasury bond fxd 1/2012/5: 14/04/2012: two year fixed coupon treasury bond fxd 4/2012/1: 06/03/2012: one year fixed coupon tresury bond fxd 3/2012/1: 06/02/2012: one year fixed coupon treasury bond fxd 2/2012/1: 13/01/2012: one year fixed coupon treasury bond fxd 1/2012/1: 28/11/2011: two year fixed coupon treasury bond ...

10-Year U.S. Treasury Yields Consolidate Losses After Lowest Daily Close Since February – Art By ...

corporatefinanceinstitute.com › resourcesTreasury Bills - Guide to Understanding How T-Bills Work How to Purchase Treasury Bills. Treasury bills can be purchased in the following three ways: 1. Non-competitive bid. In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. The yield that an investor receives is equal to the average auction price for T-bills sold at auction.

› tbills › res_tbillIndividual - Treasury Bills In Depth Feb 10, 2021 · Bills are sold at a discount. The discount rate is determined at auction. Bills pay interest only at maturity. The interest is equal to the face value minus the purchase price. Bills are sold in increments of $100. The minimum purchase is $100. All bills except 52-week bills and cash management bills are auctioned every week.

Post a Comment for "38 treasury bills coupon rate"